Questions? (800) 560-2242

Check and ACH payment processing

Check signing software versus a check signing machine.

Tired of signing checks by hand? Got writer's cramp?

Then you're probably ready to find a way to automate the process. You have a few different options when it comes to automatically signing checks.

First - The rubber stamp

Benefits: It's inexpensive.

Disadvantages: It’s messy and still involves some manual labor.

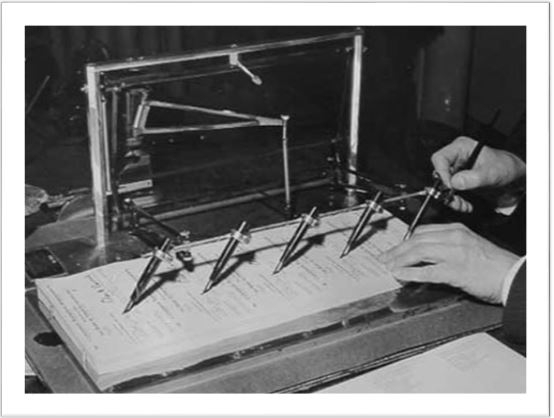

Second - A check signing machine.

Machines been around for over 200 years and they’re certainly reliable.

Benefits: They can sign as many as 200 checks per minute.

Disadvantages: They're expensive to maintain and it costs a few hundred dollars just to add a new signature. They're also bulky and take up a lot of space in the office.

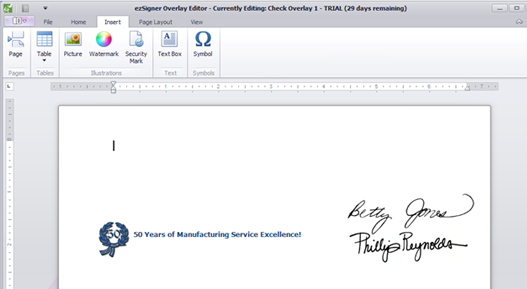

Third - Software.

When it comes to software, you have a lot of different options including having the signature added during the accounting process of writing the check. Although this can be tempting and convenient, it opens up your company to huge fraud risk. Unless you're a small business or the owner is paying the bills, we don't recommend this.

The signature should never be applied during the accounting process. Signature application or final approval of the check needs to be a distinctly different function from actually writing the check. This applies to medium and large businesses, or any business that has an accountant or accounting department paying bills.

In the world of check signing software there's THREE important points to look for before making a purchase.

1) Look for software that is independent from your accounting system.

2) Look for software able to print to blank check stock. Software designed to print the signature should also have the ability to print the MICR bank info. Printing to blank check stock cuts the cost of sending checks by 80%. You can use the same blank paper for all your business accounts and because the unused check paper has no information on it, you don't have to lock it up when it's not being used.

3) Find software that allows you to build users without giving them full administration rights and includes an audit log for those users. This allows you to manage and monitor all the activity that goes inside the software.

There are a few other things that are nice to have such as signature backgrounds, but they're not necessary in today's market.

If you need help in finding something that fits your needs feel free to reach out to anyone on our team here at Advantage Business Equipment.

Finally, keep in mind, the only way to protect 100% against check fraud is to take advantage of the Positive Pay Program from your bank.

For more information on Positive Pay click here.

What are the rights of a business in the charge back process?

We get many questions about charge backs and what the rights are for a business in the Credit Card charge process.

Unfortunately for business owners, the Credit Card processor is only a middleman in the movement of funds from a consumer’s bank and a business account.

If a consumer reports a charge as "Fraud", they are automatically protected against any damage by the FTC and Federal Law. Certain processors like PayPal and Chase Merchant Services are better at educating new businesses about their rights in the event of fraud, but they still have to abide by the Consumer Protection Act. When a fraud notice is posted, they will withdraw the funds from the business and post them back to the consumer’s card.

https://www.consumer.ftc.gov/articles/0216-protecting-against-credit-card-fraud

Even with proof of delivery and solid evidence of the purchase, consumer fraud is protected under this federal law. Business owners need to understand they are ultimately responsible for verifying all charges are not fraudulent and if they are, they are obligated to pay back the consumer. There is NO law to protect the business and there is no type of insurance for this kind of damage. Education is limited on how the flow of funds work so make sure your business takes advantage of everything your bank and CC processor offer to reduce fraud charges.

We tell our clients “The money has to come from somewhere and guess where that is…The business owner”.

Business owners do have the recourse to take a consumer to court or small claims court if they feel the charge is valid but remember, the consumer has the protection of Federal Law. Some consumers have been known to abuse the system but it is very uncommon.

Our fraud protection system does more good than harm but understand as a business owner, whenever you take a Credit Card for payment, you are liable for a charge back for up to 6 months. Here are simple steps to protect your company.

1.Use all verification systems offered by your Credit Card processor. At a minimum use Address Match, CCV verification, and match shipping address to billing address. It any of these don’t match, hold the order.

2.Call to verify all “suspicious” orders. Usually fraud attempts use a temporary phone number and will not answer if called. Listen for strange messages or ask them to verify all the shipping details if someone answers. NEVER read them their name and shipping address, ask them to verify the order and details to you. You will see they can’t. Criminals use so many names and addresses they can’t keep track of all the charges.

3.Google map the order. Many criminals will have you ship to a freight forwarder where they will ship the good overseas. Others use a vacant lot and will meet the shipping truck for delivery. If the address looks suspicious, don’t ship.

4.Google the Name in the order or the company. Also type in the email extension to see if it’s a real website. We often see fraud attempts use domain emails are used like these real examples. work@holding7th.com, service@cleanandry.com, tech@northerneast.com. Once we entered the Domain part of the email into a browser, it came back as not a valid domain or 404 error. After a quick call, it was confirmed it was fraud.

5.If fraud is suspected, immediately reverse the order and DO NOT charge the customer.

Good luck and remember to use other systems like Positive Pay to protect against check fraud as well.

How to choose the right check signing machine or software?

How to choose the right check signing software or machine for my business?

Five accounting basics every AP department needs to have in place.

Five things every accounting department needs to implement to protect the check payment and signing process.

We put together our list of the top systems we see the most successful businesses and accounting departments using to process check payments. For large businesses with established AP departments they probably already have great systems in place. The problem we see is with the new and fast-growing startups. They haven’t had time to establish systems yet so they are vulnerable to potential theft. These businesses should start early and make sure they build a secure payment process inside their growing accounting departments to avoid any check fraud issues.

Now is the time automate and secure your Accounts Payable process.

Benefits Of Outsourcing The Business Check Payment Process

From expanding marketing efforts to managing employees, business owners have more than enough work to fill each day. Most business owners and their workers spend too much time on administrative tasks. With today's technologies, a considerable amount of these tasks can be automated or outsourced to save money.

What are those MICR routing and account numbers on business checks?

What to know about MICR routing and account numbers on your business checks.

Your company name and business address are not a required piece of information for the Federal Reserve to process a check. The most important data is the row of numbers on the bottom of the check known as the MICR line. Those numbers are the check routing and checking account numbers and they have to printed in a special MICR ink.

Positive pay explained

Positive Pay is an anti fraud service available at all major Banks. This service stops paper check fraud by verifying information on checks when they are processed against the data a company provides.

When available, this service should be used by all organizations because it is proven to stop attempted check fraud.

Categories

Recent Posts

- Shredder Security Levels explained

- What Is A Shredder Used For In An Office?

- Which Is The Best Paper Shredder For A Small Office?

- PacMaster Cardboard Shredder / Packing Material Machine

- When is buying 2 commercial shredders cheaper than buying one?

- What are the rights of a business in the charge back process?

- Check signing software versus a check signing machine.

- How to choose the right check signing machine or software?

- How loud are paper shredders?

- Now is the time automate and secure your Accounts Payable process.

About

Advantage Business Equipment posts information to help businesses:

- Automate accounts payable procedures.

- Set up secure check signing software or machines.

- Research finding the correct shredder for offices or commercial businesses.

- Find the best 3D printer for businesses and schools.

- Finding the appropriate paper handling equipment for churches, mail rooms, and print shops.

- Build or find the right hard drive degausser, hard drive punch or shredder to protect confidential electronic data.

© Copyright 2025 Advantage Business Equipment. All rights reserved.